If you are new to crypto space and do not know how to buy cryptocurrency like Bitcoin, Ethereum, Cardano or Solana then we will guide you in this article as you keep reading.

Initially it will be confusing but we will guide on how to buy a cryptocurrency. Cryptocurrencies are extremely volatile and need to take a lot of care before choosing which one to buy.

There is a five steps process in buying a cryptocurrency, let’s start.

1. Buying through a Crypto Exchange or a Broker

You can buy cryptocurrencies either through a crypto exchange or a broker. There will be slight differences and comes with its own pros and cons.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange (Digital Currency Exchange) is an independent business that allows customers to buy, sell and trade digital currencies. Exchanges will have its own app and web portal with more complex interfaces with multiple trade types and advanced performance charts which intimidates new crypto investors.

Exchanges charge relatively low fees when compared with the brokers. There are around 525 cryptocurrency exchanges as per CoinMarketCap.

The top 10 Cryptocurrency exchanges in the world are given below:

- Binance

- FTX

- Coinbase Exchange

- Kraken

- Gate.io

- KuCoin

- Binance.US

- Bitfinex

- Bitstamp

- Huobi Gloabal

We have an entire blog on Top 10 Cryptocurrency Exchanges in the World. The list slightly varies as the trading volume on the exchanges vary almost every single hour.

The most popular cryptocurrency exchanges are Binance, FTX, Coinbase and etc but it depends from person to person and the services provided by the exchanges at the user’s location.

Exchanges are very convenient to buy cryptocurrency but comes with a minimal cost and the cost varies from crypto to crypto. If you are new to crypto then you need to make sure that your exchange or brokerage allows fiat currency transfers and purchase made with it. If you are an existing crypto user, you can trade for other cryptocurrencies with the available crypto in your wallet.

What is a Cryptocurrency Broker?

If you do not want to go through the hazzle and complexity of understanding an exchange then you can opt for a cryptocurrency brokerage. A cryptocurrency brokerage will take all the complexity of buying crypto for you and will provide some guidance as well in most of the cases. Some charge higher brokerage fees than the exchanges.

Others claim to be free while selling information about what you and other traders are buying and selling to a larger brokerages or funds or not executing your trade at the best possible market price. The most well-known crypto brokers are Robinhood, eToro and Webull.

2. Create a Cryptocurrency exchange account

Once you decide you can sign up to open an account either with an exchange or a broker. Most of the exchanges and brokerage have a KYC (Know Your Customer) process which needs to be completed.

KYC process and Two Factor authentication helps prevent fraud and meet regulatory requirements. For the KYC process, the platform may ask you to submit a copy of passport or driver’s license or any other identification ID and also ask you to upload a selfie to prove your appearance matches the documents submitted.

Once the verification process is completed, you can start buying, selling or trade cryptocurrencies on your account. Make sure you save your login credentials safely.

3. Process to Invest in Cryptocurrencies

If you are new then you need to buy cryptocurrencies through fiat currency by linking bank account and authorizing a wire transfer or even making the payment with a debit or credit card.

Most of the exchanges and brokerage firms let’s you buy cryptocurrency instantly just after depositing the fiat currency in the account but few make you wait for few days before you can use the money.

Most of the new investors buy cryptocurrency through a credit card, doing so it’s extremely risky and expensive. Cryptocurrency purchases with a credit card are processed as cash advances by credit card companies and subject to higher interest rate than regular purchases and also charging additional cash advance fees.

For example, apart from the fees that your crypto exchange or brokerage charge you may have to pay 5% of the transaction amount when you make a cash advance. So, it’s not suggested to buy cryptocurrency through credit cards.

4. Placing Cryptocurrency Order

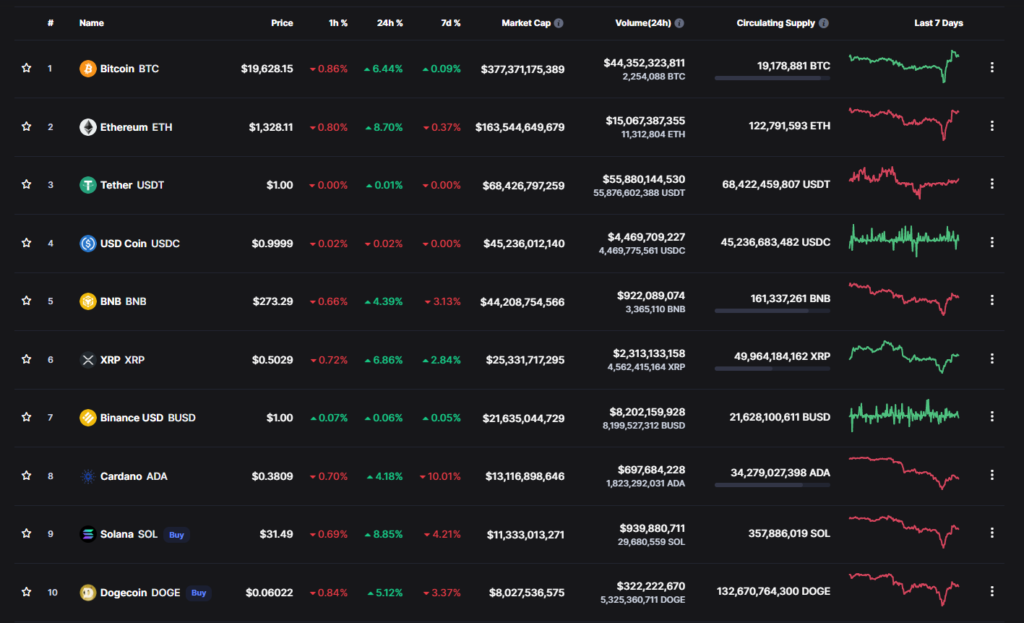

Once the fiat currency is deposited in your account, you ready to place your first cryptocurrency order. There are around 21,328 cryptocurrencies available for you to invest but do your through research or take professional guidance before start investing.

The top 10 cryptocurrencies are listed below.

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

- BNB (BNB)

- XRP (XRP)

- Binance USD (BUSD)

- Cardano (ADA)

- Solana (SOL)

- Dogecoin (DOGE)

You can also checkout our blog on the Top 10 Cryptocurrencies in the World, so that you that you know more about them. The most well known are Bitcoin, Ethereum, Solana, Cardano and Dogecoin. You do not have to buy a full cryptocurrency rather a fraction as per the budget allocated for the expensive coins like Bitcoin and Ethereum. The top 10 list might slightly vary depending on many factors on the exchanges.

5. How to store a Cryptocurrency?

Most crypto exchanges are centralized and not backed by protections like the Federal Deposit Insurance Corp (FDIC) and they are at a risk of hacking and theft. You can even lose your cryptocurrency if you forget your login credentials.

There are many who lost their millions of cryptocurrency like Bitcoin as they have lost the credentials or key phases. If the cryptocurrency is through a broker, you may have little to no choice on how the cryptocurrency is stored.

Buying a cryptocurrency though an exchange provides more options to the user.

Exchange

When you buy a cryptocurrency, it’s typically stored in a so-called wallet attached to the exchange. If you are not satisfied with the exchange, you can move the cryptocurrency to another exchange or a hot wallet or a cold wallet.

You can store or hold the crypto on all the exchanges like Binance and other.

Hot Wallets

Hot Crypto wallets that are stored online and run-on Internet connected devices such as Phones, Tablets and Computers. They are convenient but there’s a higher risk of theft as they are still connected to the Internet.

Exodus wallet is an example of hot wallet. A hot wallet has 12 word phrases and private keys secret. Anyone who has access to the private keys would have full access to your funds. Private keys are different from the public receiving address.

Cold Wallets

Cold wallets are the most secure options as they are not connected to the Internet. Cold wallets are best for holding cryptocurrency. They are in the form of external devices like USB stick or a hard drive.

You need to be extremely careful with the cold wallets as if you lose the keycode associated with the or the device break or fails you many never able to get your cryptocurrency back again. But some cold wallets are run by custodians who can help you get back into your account if you are locked out.

As cold wallets are not connected to the Internet, it makes funds stored in them harder to use but it’s one of the benefit for the owner and becomes difficulty for the hackers. The crypto stored in cold wallets are not used frequently but stored for longer periods of time.

Alternative Ways to Buy Cryptocurrency

If anyone of your friend, family member or a known person selling cryptocurrency of your choice even then you can buy through them. You can check the worth of the currency and you can provide then your cryptocurrency deposit address and they can send it.

Once you receive the cryptocurrency, you can pay the amount through the desired method. In this way, you can even avoid the transaction fee that the exchanges charge but it’s a very scenario.

At the same time, you can even sell the crypto directly to any and collect the worth of fiat currency or any other crypto in the form of payment.

Hope that you have an idea now on how to buy cryptocurrencies through exchanges or brokers. Happy crypto investing.

You can also check out our Gate.io review.